What is Yield Farming and How Does it Work? Dive into the world of crypto with this breakdown that will have you feeling like a pro in no time.

From understanding the basics to exploring advanced strategies, this guide has got you covered.

What is Yield Farming?

Yield farming is a strategy used in the cryptocurrency space to generate returns by staking or locking up crypto assets in various DeFi protocols. Users earn rewards in the form of additional tokens or interest for providing liquidity to these platforms.

Platforms Offering Yield Farming Opportunities

- One popular platform for yield farming is Compound Finance, where users can lend out their assets and earn interest in return.

- Uniswap is another decentralized exchange that allows users to provide liquidity to different trading pairs and earn fees and rewards in return.

- Yearn Finance is a platform that automates yield farming strategies by moving funds between different DeFi protocols to maximize returns.

Differences from Traditional Savings or Investments

- Yield farming typically offers much higher returns compared to traditional savings accounts or investment methods due to the inherent risks involved in DeFi protocols.

- Traditional savings accounts usually offer fixed interest rates, while yield farming rewards can vary depending on market conditions and protocol incentives.

- Yield farming requires users to actively manage their investments and stay informed about the latest DeFi projects, unlike traditional investments that often follow a more passive approach.

How Does Yield Farming Work?

Yield farming is a process in decentralized finance (DeFi) where users provide liquidity to various protocols in exchange for rewards. Let’s dive into how yield farming works and the key elements involved.

Providing Liquidity

When participating in yield farming, users contribute their cryptocurrencies to liquidity pools, which are used to facilitate trading on decentralized exchanges (DEXs). By providing liquidity, users help maintain the balance of assets in the pool and earn a share of the trading fees generated.

Earning Rewards

In return for providing liquidity, users receive rewards in the form of additional tokens. These rewards can come from a variety of sources, such as trading fees, yield farming incentives, or newly minted tokens. The goal is to maximize returns by strategically choosing which pools to participate in based on potential rewards.

Potential Risks

Yield farming can be lucrative, but it also comes with risks. One of the main risks is impermanent loss, which occurs when the value of the assets in the liquidity pool changes relative to when they were initially deposited. This loss can offset the rewards earned through yield farming, leading to a net loss for the user.

Role of Liquidity Pools

Liquidity pools play a crucial role in yield farming by providing the necessary liquidity for trading on DEXs. Users can contribute their assets to these pools and earn rewards based on the trading activity within the pool. The more liquidity a pool has, the more efficient trading can be, leading to better returns for participants.

Impermanent Loss

Impermanent loss is a key concept in yield farming that can impact the overall returns for participants. This loss occurs when the price of the assets in the liquidity pool diverges from their initial ratio. As a result, users may end up with fewer assets than they initially deposited, reducing their overall profits from yield farming.

Strategies in Yield Farming

Yield farming offers various strategies for maximizing returns, attracting both experienced and novice investors. Understanding these strategies is crucial for success in the ever-evolving DeFi landscape. Let’s delve into some popular approaches used by yield farmers.

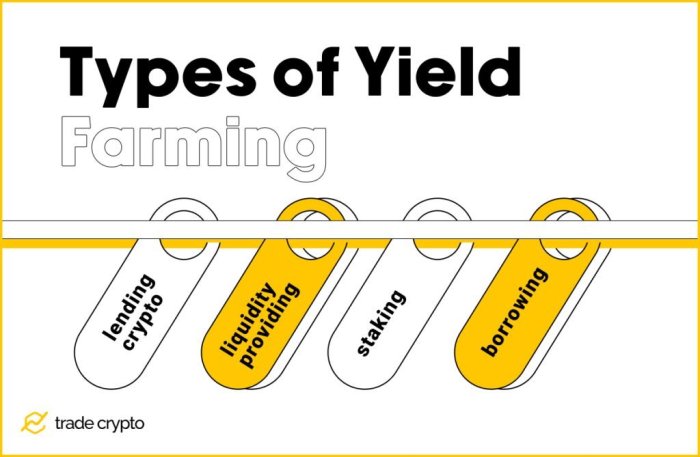

Staking

Staking involves locking up cryptocurrencies in a digital wallet to support a blockchain network’s operations. In return, stakers earn rewards, which can be in the form of additional tokens or a percentage of transaction fees. This strategy is relatively low-risk and requires minimal effort, making it a popular choice for beginners.

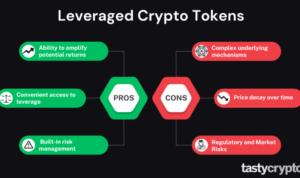

Liquidity Providing

Liquidity providing involves supplying cryptocurrencies to decentralized exchanges (DEXs) or liquidity pools. By providing liquidity, users earn a share of trading fees generated on the platform. However, this strategy carries higher risks compared to staking, as impermanent loss could occur due to price fluctuations.

Yield Optimization, What is Yield Farming and How Does it Work

Yield optimization strategies focus on maximizing returns by leveraging different DeFi protocols. This can include yield aggregators that automatically move funds between various platforms to capitalize on the highest yields available. However, these strategies often involve more complexity and risk compared to staking or liquidity providing.

Tips for Beginners

– Do thorough research before investing in any yield farming strategy.

– Start with small amounts to familiarize yourself with the process and risks involved.

– Diversify your investments across multiple platforms to minimize risk.

– Stay updated on the latest trends and developments in the DeFi space to adapt your strategies accordingly.

It’s essential to approach yield farming with caution and a willingness to learn, as the high potential returns are often accompanied by significant risks. By understanding and implementing these strategies effectively, investors can navigate the DeFi landscape successfully.

Risks and Considerations: What Is Yield Farming And How Does It Work

When it comes to yield farming, there are certain risks and considerations that participants need to be aware of. These risks include smart contract vulnerabilities and market volatility, which can result in financial losses if not managed properly. It’s crucial to understand these risks and take necessary precautions to mitigate them.

Smart Contract Vulnerabilities

Smart contracts are at the core of many yield farming protocols, and they are susceptible to bugs and vulnerabilities. These vulnerabilities can be exploited by malicious actors to steal funds or manipulate the protocol. It’s essential for participants to conduct a thorough audit of the smart contracts before investing any funds to minimize the risk of falling victim to such attacks.

Market Volatility

The cryptocurrency market is known for its high volatility, which can lead to significant price fluctuations in a short period. This volatility can impact the value of the assets being staked or farmed in yield farming protocols. Participants should be prepared for sudden price swings and have risk management strategies in place to protect their investments.

Mitigating Risks

To mitigate the risks associated with yield farming, participants can take several steps. Diversifying their investments across different protocols and assets can help spread out the risk. Setting stop-loss orders and using hedging strategies can also protect against sudden market downturns. Additionally, staying informed about the latest developments in the DeFi space and being cautious of new, unverified protocols can help avoid potential pitfalls.

Importance of Research

Before engaging in yield farming activities, it is crucial for participants to conduct thorough research. This includes understanding the underlying protocols, evaluating the risks involved, and assessing the credibility of the developers behind the project. By staying informed and making well-informed decisions, participants can reduce the likelihood of falling victim to scams or suffering financial losses.