The Evolution of Cryptocurrencies in the Global Market sets the stage for a groundbreaking exploration of the dynamic world of digital currencies, where innovation meets finance in an unprecedented manner. As we delve into the realms of cryptocurrency history, market trends, and future outlook, get ready to witness the transformation of traditional finance into a new era of decentralized possibilities.

Cryptocurrencies have come a long way since their inception, revolutionizing how we perceive and interact with money on a global scale. Strap in and prepare to embark on an exhilarating journey through the evolution of this digital financial landscape.

The History of Cryptocurrencies: The Evolution Of Cryptocurrencies In The Global Market

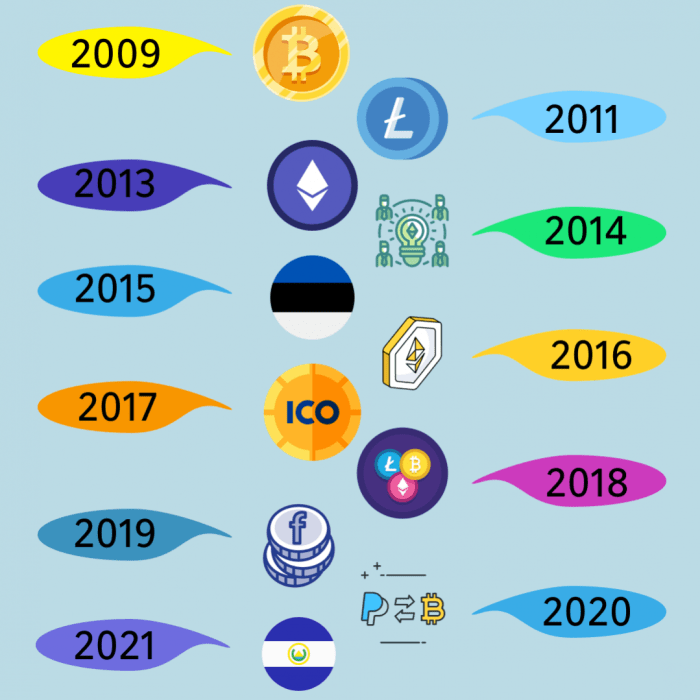

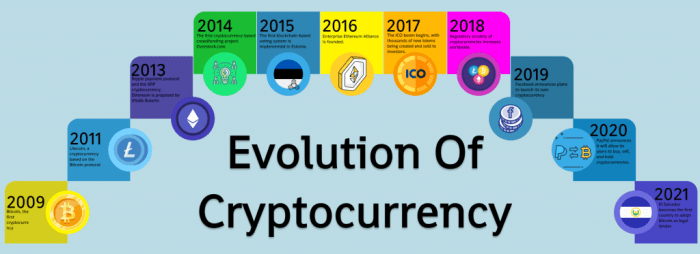

Cryptocurrencies have a fascinating origin story that dates back to the early 2000s. The concept of digital currency was introduced to the world with the creation of Bitcoin in 2009 by an anonymous person or group known as Satoshi Nakamoto. This marked the beginning of a new era in finance and technology.

Origins of Cryptocurrencies, The Evolution of Cryptocurrencies in the Global Market

The idea of a decentralized digital currency had been explored by various researchers and developers before Bitcoin. However, it was Nakamoto’s whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” that laid the foundation for the first cryptocurrency. The goal was to create a currency that was not controlled by any central authority and could be used for peer-to-peer transactions securely.

Key Events in the Evolution of Cryptocurrencies

– In 2010, the first real-world transaction using Bitcoin took place when a programmer paid 10,000 BTC for two pizzas. This event highlighted the potential of cryptocurrencies for everyday use.

– The creation of alternative cryptocurrencies, or altcoins, such as Litecoin and Ethereum, introduced new features and functionalities to the market, expanding the possibilities beyond just a digital currency.

– The rise of Initial Coin Offerings (ICOs) in 2017 saw a surge in new cryptocurrency projects being launched, leading to both innovation and controversy in the industry.

– Regulatory developments around the world have played a significant role in shaping the evolution of cryptocurrencies, with different countries adopting varying approaches to their legality and use.

Evolution of Digital Currency

Over time, the concept of digital currency has evolved to encompass not just cryptocurrencies but also central bank digital currencies (CBDCs) and stablecoins. CBDCs are issued by central banks and aim to provide a digital alternative to physical cash, while stablecoins are pegged to a stable asset like the US dollar to reduce price volatility.

The Rise of Bitcoin

Bitcoin, the first decentralized cryptocurrency, has had a significant impact on the global market since its inception in 2009. Its introduction revolutionized the way people viewed and conducted financial transactions, paving the way for a new era of digital currency.

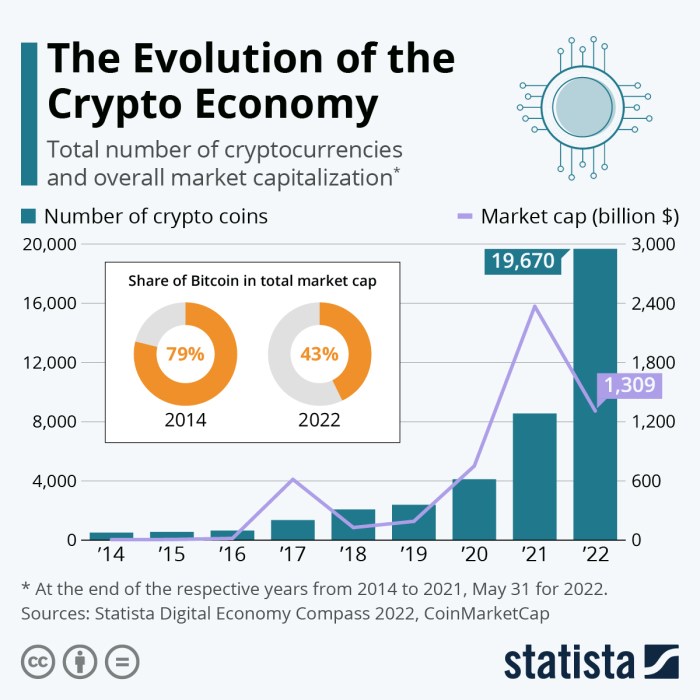

Bitcoin’s market dominance is unparalleled compared to other cryptocurrencies. It holds the largest market capitalization and trading volume in the cryptocurrency space, making it the most widely recognized and accepted digital currency worldwide.

Several factors have contributed to Bitcoin’s popularity and widespread adoption. Its limited supply of 21 million coins creates scarcity, driving up demand and value. Additionally, its decentralized nature provides users with financial freedom and privacy, appealing to those looking to bypass traditional banking systems.

Bitcoin’s Impact on the Global Market

Bitcoin’s impact on the global market extends beyond just being a digital currency. It has disrupted traditional financial systems, challenging the status quo and forcing institutions to adapt to the rise of cryptocurrencies. The blockchain technology underlying Bitcoin has also been widely adopted in various industries for its secure and transparent nature.

Bitcoin’s Market Dominance

- Bitcoin holds the largest market capitalization among all cryptocurrencies.

- Its trading volume surpasses that of any other digital asset in the market.

- Bitcoin’s dominance index often hovers around 40-50%, indicating its significant presence in the crypto space.

Factors Contributing to Bitcoin’s Popularity

- The limited supply of 21 million coins creates scarcity and drives up demand.

- Bitcoin’s decentralized nature provides users with financial freedom and privacy.

- Its security features and immutability make it a trusted store of value.

Development of Altcoins

As the popularity of cryptocurrencies grew, alternative coins, or altcoins, began to emerge in the market. These altcoins aimed to provide unique features and improvements over Bitcoin.

Examples of Popular Altcoins

- Ethereum: Known for its smart contract functionality and decentralized applications.

- Ripple (XRP): Designed for real-time gross settlement system and currency exchange.

- Litecoin: Considered the silver to Bitcoin’s gold, with faster transaction times.

Comparison with Bitcoin

Altcoins differ from Bitcoin in various ways, including:

- Technology: Altcoins often introduce new technologies or improvements, such as smart contracts, faster transaction speeds, or enhanced privacy features.

- Market Value: While Bitcoin remains the dominant cryptocurrency in terms of market capitalization, altcoins have gained popularity and value, offering investors a diverse range of options.

Regulations and Legal Framework

In the world of cryptocurrencies, regulations and legal frameworks play a crucial role in shaping the market dynamics. Let’s delve into the evolving landscape of regulations for cryptocurrencies worldwide and how they impact the global market.

Evolving Regulatory Landscape

The regulatory landscape for cryptocurrencies varies significantly from country to country. Some nations have embraced cryptocurrencies, providing a clear legal framework for their use and trading, while others have taken a more cautious approach or even banned them altogether. This diversity in regulations creates challenges for individuals and businesses operating in the cryptocurrency space, leading to uncertainty and compliance issues.

Challenges and Opportunities

The varying regulations present both challenges and opportunities for the cryptocurrency market. On one hand, stringent regulations can limit the growth and adoption of cryptocurrencies, making it difficult for businesses to operate within the legal boundaries. On the other hand, clear regulations can provide a level of legitimacy and security, attracting institutional investors and promoting mainstream acceptance.

Impact on Global Market

Regulatory decisions have a direct impact on the global market for cryptocurrencies. News of regulatory crackdowns or bans in major economies can lead to significant price fluctuations and market volatility. Conversely, regulatory clarity and support can boost investor confidence and drive market growth. As governments around the world continue to grapple with the regulatory challenges posed by cryptocurrencies, the market remains in a state of flux, with opportunities and risks abound.

Cryptocurrencies in Traditional Finance

Cryptocurrencies have been making waves in traditional finance systems, challenging the norms of banking and investment sectors. The impact of digital assets on these industries is undeniable, with a growing trend towards adoption by institutional investors.

Integration of Cryptocurrencies

Cryptocurrencies are gradually being integrated into traditional financial systems, offering new opportunities for transactions and investments. This integration allows for faster and more secure cross-border transactions, reducing the need for intermediaries and lowering transaction costs.

Impact on Banking Sector

The rise of cryptocurrencies has forced banks to reevaluate their role in the financial ecosystem. With decentralized finance (DeFi) platforms gaining popularity, banks are facing competition in providing lending, borrowing, and other financial services. This shift challenges banks to adapt to the changing landscape and explore ways to incorporate digital assets into their offerings.

Adoption by Institutional Investors

Institutional investors are increasingly recognizing the potential of cryptocurrencies as an asset class. With the growth of cryptocurrency investment funds and the introduction of Bitcoin futures trading on traditional exchanges, institutional players are taking steps to diversify their portfolios with digital assets. This trend indicates a broader acceptance of cryptocurrencies in the traditional investment space.

Cryptocurrency Market Trends

Cryptocurrency market trends are constantly evolving, influenced by various factors that impact the prices and values of digital assets. Understanding these trends is crucial for investors and stakeholders in the crypto space.

Factors Influencing Volatility of Cryptocurrency Prices

- Market Demand: Fluctuations in demand for specific cryptocurrencies can lead to price volatility.

- Regulatory Changes: Government regulations and policies can affect the market sentiment and price stability.

- Market Manipulation: Activities such as pump and dump schemes can artificially inflate or deflate prices.

- Technological Developments: Updates or advancements in blockchain technology can impact the value of cryptocurrencies.

Role of Market Sentiment and External Events

- Market Sentiment: Investor emotions and perceptions play a significant role in shaping cryptocurrency prices.

- External Events: Global economic conditions, geopolitical events, and mainstream adoption can influence market trends.

- Social Media Influence: Trends on social platforms can create FOMO (fear of missing out) or FUD (fear, uncertainty, doubt) affecting prices.

- Media Coverage: News articles and media reports can have a direct impact on market sentiment and cryptocurrency values.

Cryptocurrency Adoption and Use Cases

Cryptocurrencies are gaining traction in various industries due to their unique features and benefits. Let’s explore some real-world applications and the potential challenges and benefits of widespread adoption.

Real-World Applications of Cryptocurrencies

- Online Retail: Some e-commerce platforms accept cryptocurrencies as a form of payment, providing a secure and efficient way for customers to make purchases.

- Travel Industry: Travel agencies and airlines are starting to accept crypto payments for booking flights and accommodations, offering travelers more payment options.

- Gaming: Cryptocurrencies are used in the gaming industry for in-game purchases, virtual goods, and rewards, creating a seamless payment experience for gamers.

Potential Benefits and Challenges of Widespread Cryptocurrency Adoption

- Benefits:

- Lower Transaction Fees: Cryptocurrency transactions often have lower fees compared to traditional banking systems, saving money for users.

- Financial Inclusion: Cryptocurrencies can provide financial services to the unbanked population, enabling access to global markets.

- Transparency and Security: Blockchain technology ensures transparency and security of transactions, reducing fraud and enhancing trust.

- Challenges:

- Regulatory Uncertainty: The lack of clear regulations and legal framework for cryptocurrencies poses challenges for widespread adoption and mainstream acceptance.

- Volatility: The price volatility of cryptocurrencies can deter businesses and individuals from using them as a stable medium of exchange.

- Security Concerns: Cybersecurity threats and hacking incidents in the crypto space raise concerns about the safety of digital assets and personal information.

Use of Cryptocurrencies for Remittances, Cross-Border Payments, and Decentralized Finance

- Remittances: Cryptocurrencies offer a faster and cheaper alternative for cross-border remittances, especially for individuals sending money to family members in other countries.

- Cross-Border Payments: Businesses use cryptocurrencies for international transactions, bypassing traditional banking systems and reducing transfer delays and costs.

- Decentralized Finance (DeFi): Cryptocurrencies are at the forefront of the DeFi movement, enabling decentralized lending, borrowing, and trading without intermediaries.

Future Outlook for Cryptocurrencies

Cryptocurrencies have come a long way since the inception of Bitcoin. As we look towards the future, several potential developments in the cryptocurrency market can be anticipated. The role of blockchain technology will continue to be pivotal in shaping the future of digital currencies. While challenges remain, there are also significant opportunities for cryptocurrencies to thrive in the global economy.

Increased Mainstream Adoption

With growing acceptance and understanding of cryptocurrencies, we can expect to see increased mainstream adoption. More businesses and individuals are likely to embrace digital currencies for various transactions, leading to a more widespread use of cryptocurrencies in everyday life.

Integration with Traditional Finance

As regulatory frameworks become clearer and more established, cryptocurrencies are expected to integrate further into traditional finance systems. This integration could potentially bridge the gap between digital assets and traditional financial instruments, creating new opportunities for investors and institutions.

Technological Advancements

Advancements in blockchain technology will continue to drive innovation in the cryptocurrency space. We can anticipate the development of faster, more scalable, and secure blockchain networks, enabling new use cases and applications for digital currencies.

Global Regulatory Landscape

The regulatory landscape for cryptocurrencies is likely to evolve further, with more countries defining clear guidelines for the use and trading of digital assets. This regulatory clarity can provide a more stable environment for cryptocurrency businesses to operate and grow.

Market Volatility and Stability

While market volatility has been a characteristic of the cryptocurrency space, efforts to increase stability and reduce volatility are expected to continue. The development of stablecoins and other mechanisms to mitigate price fluctuations could help attract more institutional investors to the market.