Investing for Beginners sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Embark on a journey through the world of investments, where opportunities abound and financial literacy is key to success.

Importance of Investing for Beginners

Investing for beginners may sound like a big leap, but let me break it down for you – it’s crucial for building your wealth and securing your financial future. Starting to invest early can set you up for success, providing you with a way to grow your money over time and reach those big financial goals you’ve been dreaming about.

Benefits of Starting to Invest Early

When you start investing early, you give your money more time to grow through the power of compound interest. This means that not only are you earning returns on your initial investment, but you’re also earning returns on those returns. It’s like a money-making snowball effect that can exponentially increase your wealth over time.

- Compound interest can help your money grow faster than if you were just saving it in a regular bank account.

- Starting early allows you to take advantage of market fluctuations and ride out any ups and downs in the market.

- By investing early, you can develop good financial habits and set yourself up for a more secure financial future.

Achieving Long-Term Financial Goals through Investing

Investing is not just about making money in the short term – it’s about setting yourself up for long-term financial success. Whether you’re saving for retirement, buying a house, or starting a business, investing can help you reach those big financial goals that may seem out of reach.

- Investing can provide you with a way to build wealth over time and secure your financial future.

- By investing in a diverse portfolio, you can spread out your risk and increase your chances of long-term success.

- Setting clear financial goals and investing towards them can help you stay disciplined and focused on your financial future.

Types of Investments

Investing can be a great way to grow your wealth over time, but it’s important to understand the different types of investments available to beginners. Each type comes with its own set of risks and rewards, so it’s crucial to do your research and choose the right option for your financial goals.

Stocks

Stocks represent ownership in a company and can offer high returns, but they also come with high volatility. Beginner investors should consider diversifying their stock portfolio to spread out the risk.

Bonds

Bonds are debt securities issued by governments or corporations. They offer more stability compared to stocks and provide fixed interest payments. However, the returns are typically lower than what you could potentially earn from stocks.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers, making them a good option for beginners who want a hands-off approach to investing.

Real Estate

Investing in real estate involves purchasing properties with the goal of generating rental income or selling for a profit. While real estate can provide a steady income stream, it also requires significant upfront capital and ongoing maintenance costs.

ETFs

Exchange-traded funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and lower costs compared to traditional mutual funds, making them a popular choice for beginner investors.

Short-term vs. Long-term Investments

Short-term investments are typically held for less than a year and are more liquid, meaning you can access your money quickly. They are generally less risky but offer lower returns. On the other hand, long-term investments are held for several years or more and have the potential for higher returns, but they also come with higher risks and volatility.

Setting Investment Goals

Setting investment goals is crucial for beginners to have a clear direction and purpose for their investment journey. By establishing realistic goals, investors can stay focused and motivated to achieve financial success.

Steps to Set Realistic Investment Goals

- Define your financial objectives: Determine why you are investing and what you hope to achieve.

- Assess your risk tolerance: Understand how much risk you are willing to take with your investments.

- Set specific and measurable goals: Clearly Artikel what you want to accomplish and how you will measure success.

- Consider your time horizon: Decide whether your goals are short-term, medium-term, or long-term.

- Regularly review and adjust your goals: Continuously monitor your progress and make changes as needed.

Significance of Setting a Timeline for Investment Goals

Setting a timeline for investment goals helps investors establish a clear deadline for achieving their objectives. It provides a sense of urgency and accountability, encouraging investors to stay on track and make informed decisions about their investments.

Examples of Short-Term and Long-Term Investment Goals

- Short-Term Goal: Save $1,000 in three months to create an emergency fund.

- Long-Term Goal: Accumulate $500,000 for retirement in 20 years through a diversified investment portfolio.

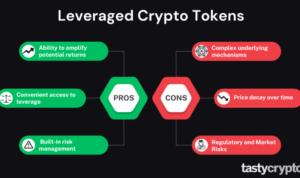

Risk Management in Investing

Investing always involves some level of risk, as the value of investments can go up or down based on various factors. Risk management in investing refers to the strategies and techniques investors use to minimize potential losses and protect their investment capital.

Strategies for Mitigating Investment Risks

- Diversification: One of the most important strategies for managing risk is diversifying your investment portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of any one investment performing poorly.

- Asset Allocation: Another key strategy is determining the right mix of assets in your portfolio based on your risk tolerance, investment goals, and time horizon. By balancing high-risk, high-reward investments with safer, more stable options, you can create a portfolio that aligns with your risk profile.

- Stop-Loss Orders: Setting stop-loss orders on your investments can help limit potential losses by automatically selling a security when it reaches a certain price. This can prevent emotion-driven decision-making during market fluctuations.

- Research and Due Diligence: Conducting thorough research and analysis before making investment decisions can help you identify potential risks and make informed choices. Stay informed about market trends, economic indicators, and company performance to minimize unexpected risks.

The Importance of Diversification in an Investment Portfolio

Diversification is crucial in risk management because it helps spread out risk across different investments, reducing the impact of a single asset’s performance on your overall portfolio. By investing in a variety of assets with different risk profiles, you can increase the chances of achieving a more stable and consistent return over time. Remember, the goal is not to eliminate all risk but to manage it effectively to achieve your financial goals.

Investment Platforms and Tools: Investing For Beginners

When it comes to investing, choosing the right platform and tools can make a huge difference in your success. Let’s dive into some popular options for beginners and key features to look for.

Popular Investment Platforms for Beginners

- Robinhood: Known for its user-friendly interface and commission-free trades, great for beginners.

- Wealthfront: Offers automated investing and financial planning services, ideal for hands-off investors.

- Acorns: Rounds up your everyday purchases and invests the spare change, perfect for beginners looking to start small.

Key Features to Look for in an Investment Platform

- Diverse Investment Options: Look for platforms that offer a variety of investment choices to build a well-rounded portfolio.

- User-Friendly Interface: A platform that is easy to navigate and understand can help beginners feel more comfortable.

- Low Fees: Pay attention to fees such as trading fees, account management fees, and expense ratios to maximize your returns.

Role of Investment Tools, Investing for Beginners

Investment tools like robo-advisors and investment apps play a crucial role in simplifying the investing process for beginners. Robo-advisors use algorithms to create and manage investment portfolios based on your goals and risk tolerance, taking the guesswork out of investing. Investment apps provide access to your investments on-the-go, allowing you to monitor your portfolio and make informed decisions anytime, anywhere.

Building a Diversified Portfolio

Diversification is a key strategy in investing that involves spreading your investments across different asset classes to reduce risk and improve overall returns. By diversifying your portfolio, you can protect yourself from the volatility of any single investment and increase the likelihood of achieving your financial goals.

Importance of Diversification

Diversification helps to minimize the impact of a potential loss in any one investment by spreading your money across various types of assets. This can help you achieve a more stable and consistent return over time, even if some individual investments underperform.

Tips for Building a Diversified Portfolio

- Invest in different asset classes such as stocks, bonds, real estate, and commodities.

- Allocate your investments across various industries and sectors to reduce concentration risk.

- Diversify globally by investing in international markets to further spread your risk.

- Consider adding alternative investments like hedge funds or private equity to further diversify your portfolio.

Allocation of Assets Across Different Investment Types

When allocating assets in a diversified portfolio, it’s important to consider your risk tolerance, investment goals, and time horizon. For example, younger investors with a longer time horizon may allocate more to equities for higher growth potential, while older investors may lean towards more conservative investments like bonds for capital preservation.