How to Use DeFi for Earning Interest on Your Crypto sets the stage for diving into the world of decentralized finance, where your crypto assets can work for you while you chill and stack those gains, ya know?

This guide will walk you through the ins and outs of maximizing your earnings through DeFi platforms, from setting up your wallet to selecting the right platform and securing your assets like a boss.

Introduction to DeFi and Earning Interest: How To Use DeFi For Earning Interest On Your Crypto

DeFi, short for Decentralized Finance, refers to a financial system that operates without traditional intermediaries like banks. Instead, it utilizes blockchain technology and smart contracts to provide financial services. One popular feature of DeFi is the ability to earn interest on your crypto assets by participating in various lending and borrowing protocols offered by decentralized platforms.

Benefits of Earning Interest on Your Crypto through DeFi Platforms

- Higher interest rates: DeFi platforms typically offer higher interest rates compared to traditional banks, allowing you to earn more on your crypto holdings.

- Accessibility: Anyone with an internet connection can participate in DeFi lending protocols, democratizing access to financial services.

- Transparency: Transactions on DeFi platforms are recorded on the blockchain, providing a high level of transparency and auditability.

- Diversification: By earning interest on your crypto assets, you can diversify your investment portfolio and potentially increase your overall returns.

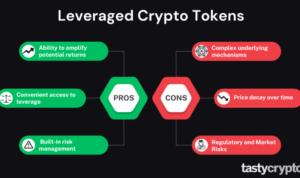

Risks Associated with DeFi Interest Earning

- Smart contract risk: DeFi platforms rely on smart contracts to execute transactions, and vulnerabilities in these contracts can be exploited by hackers.

- Market volatility: The value of crypto assets can be highly volatile, leading to fluctuations in the interest rates offered by DeFi platforms.

- Regulatory uncertainty: DeFi operates in a relatively unregulated space, which can expose investors to legal and compliance risks.

Setting Up Your DeFi Wallet

When it comes to diving into the world of decentralized finance (DeFi), setting up a secure wallet is crucial. Your DeFi wallet will be the gateway to earning interest on your crypto assets, so choosing the right one and taking the necessary security measures is key.

Choosing a Suitable DeFi Wallet

- Look for wallets that support a wide range of cryptocurrencies to maximize your earning potential.

- Check for compatibility with the DeFi platforms you plan to use to ensure seamless transactions.

- Opt for wallets that offer features like two-factor authentication and seed phrase backup for enhanced security.

Creating a DeFi Wallet

- Research and choose a reputable DeFi wallet provider like MetaMask or Trust Wallet.

- Download the wallet application from the official website or app store onto your device.

- Follow the on-screen instructions to set up a new wallet, create a strong password, and secure your seed phrase.

- Verify your identity if required by the wallet provider to complete the setup process.

Importance of Security Measures

Protecting your DeFi wallet is crucial to safeguard your funds from unauthorized access and potential cyber threats.

Always keep your seed phrase private and never share it with anyone. This phrase is the key to accessing your wallet and should be stored securely offline.

Enable two-factor authentication whenever possible and regularly update your wallet software to patch any security vulnerabilities.

Selecting the Right DeFi Platform

When it comes to choosing the right DeFi platform for earning interest on your crypto, you need to consider several key factors. These factors can help you determine which platform aligns best with your financial goals and risk tolerance.

Comparing Different DeFi Platforms

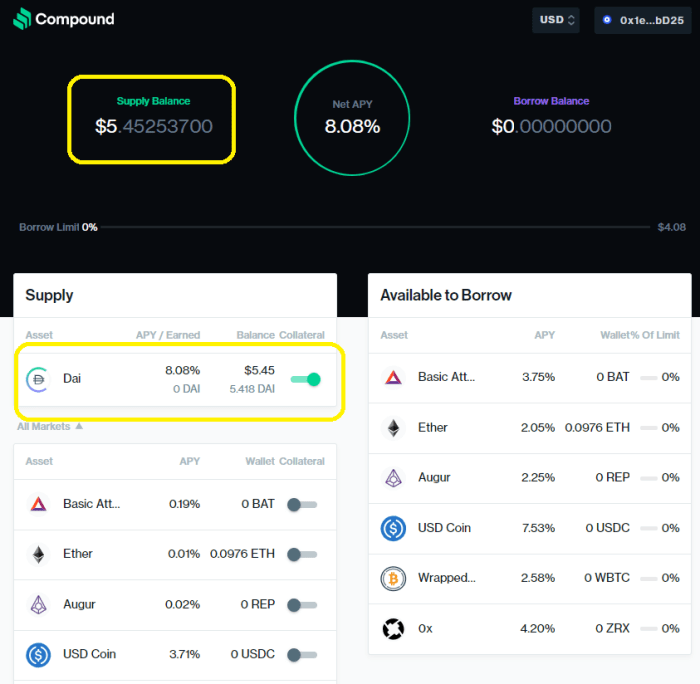

- Compound Finance: Known for its algorithmic money market protocol that allows users to lend and borrow various cryptocurrencies.

- Aave: Offers a wide range of assets for lending and borrowing, with a unique feature of flash loans.

- Yearn Finance: Focuses on optimizing yield farming strategies for users to earn the highest interest rates possible.

Factors to Consider When Choosing a DeFi Platform

- Security: Look for platforms with a proven track record of security measures to protect your funds.

- Interest Rates: Compare the interest rates offered by different platforms to ensure you are getting the best returns.

- Liquidity: Consider the liquidity of the platform to easily enter and exit your positions without significant slippage.

- User Experience: Opt for platforms that are user-friendly and provide a seamless experience for managing your investments.

Popular DeFi Platforms with Competitive Interest Rates

- Compound Finance: Offers competitive interest rates on various cryptocurrencies and has a user-friendly interface.

- Aave: Known for its competitive interest rates and innovative features like flash loans.

- Yearn Finance: Focuses on maximizing yield for users, often leading to higher interest rates compared to traditional platforms.

Depositing Crypto and Earning Interest

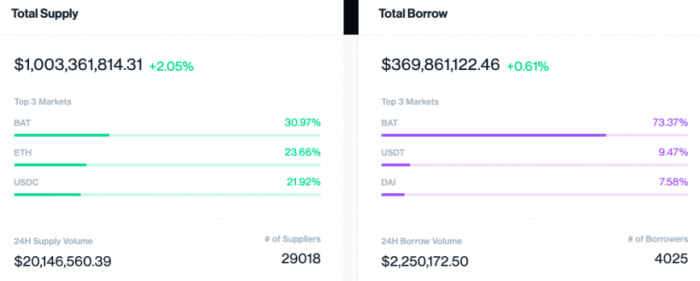

Cryptocurrency can be deposited into a DeFi platform to start earning interest on your holdings. When you deposit your crypto assets, you essentially lend them to the platform, which then uses them for various purposes such as lending, trading, and providing liquidity.

How Interest is Calculated and Earned

Interest on your deposited crypto is typically calculated based on the supply and demand dynamics within the DeFi platform. The platform uses your assets for lending or other activities, generating profits in the process. The interest you earn is a share of these profits, usually distributed periodically.

- Interest Calculation: The interest you earn is calculated based on the amount of crypto you have deposited and the prevailing interest rates on the platform. The more you deposit and the higher the interest rates, the more you can earn.

- Interest Payment: Interest earned is usually paid out in the same cryptocurrency you deposited, although some platforms offer the option to earn in different assets. The frequency of interest payouts can vary, so it’s essential to check the platform’s policies.

- Compounding Earnings: To maximize your earnings, you can choose to reinvest the interest you earn back into your deposit. This process, known as compounding, allows you to earn interest on your initial deposit as well as on the interest accrued.

Tips for Maximizing Your Earnings

- Diversify Your Holdings: Spread your deposits across different cryptocurrencies to reduce risk and potentially earn higher returns.

- Monitor Interest Rates: Keep an eye on the interest rates offered by different DeFi platforms and switch to platforms offering better rates to maximize your earnings.

- Stay Informed: Stay updated on market trends, platform changes, and new opportunities in the DeFi space to make informed decisions about your deposits.

Risks and Security Measures

When it comes to using DeFi platforms for earning interest on your crypto, there are certain risks involved that you need to be aware of. However, with the right security measures in place, you can mitigate these risks and protect your assets.

Common Risks Associated with DeFi Interest Earning

- Smart Contract Risks: Vulnerabilities in smart contracts can lead to hacks and loss of funds.

- Impermanent Loss: Fluctuations in asset prices can result in impermanent loss when providing liquidity.

- Platform Risks: DeFi platforms can be susceptible to bugs, exploits, and rug pulls.

- Regulatory Risks: DeFi regulations are still evolving, which could lead to legal uncertainties.

Strategies for Mitigating Risks in DeFi Interest Earning

- Research: Thoroughly research DeFi platforms before depositing your funds.

- Diversification: Spread your investments across different platforms to reduce risk.

- Use Secure Wallets: Store your crypto in secure wallets and avoid keeping large amounts on exchanges.

- Stay Informed: Keep up to date with the latest news and developments in the DeFi space.

Recommendations for Securing Your Crypto Assets in DeFi, How to Use DeFi for Earning Interest on Your Crypto

- Enable Two-Factor Authentication (2FA) on your accounts for an added layer of security.

- Use Hardware Wallets: Consider using hardware wallets for storing your crypto offline.

- Audit Smart Contracts: Verify the security and integrity of smart contracts before using DeFi platforms.

- Be Cautious: Be wary of high-yield opportunities that seem too good to be true, as they may be scams.