As How to Leverage Crypto for Long-Term Wealth Building takes center stage, this opening passage beckons readers with american high school hip style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Cryptocurrency is the new wave, and knowing how to ride it for long-term wealth is key. Let’s dive into strategies and tips to make your crypto portfolio pop!

Understanding Crypto Investment

Cryptocurrency has emerged as a popular investment vehicle in recent years, offering individuals the opportunity to diversify their portfolios and potentially achieve long-term wealth growth. Unlike traditional assets like stocks or real estate, cryptocurrencies are digital currencies that operate on decentralized networks using blockchain technology.

Types of Cryptocurrencies

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold.

- Ethereum (ETH): Known for its smart contract functionality and decentralized applications.

- Ripple (XRP): Designed for facilitating cross-border payments and transactions.

- Litecoin (LTC): A peer-to-peer cryptocurrency created as a ‘lighter’ version of Bitcoin.

- Various Altcoins: Alternative cryptocurrencies that serve different purposes and functions in the market.

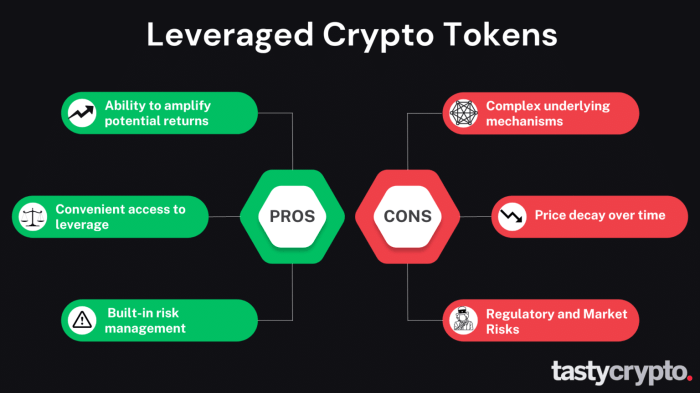

Risks and Rewards

- Volatility: Cryptocurrencies are known for their price fluctuations, which can lead to significant gains or losses.

- Regulatory Uncertainty: Government regulations can impact the value and adoption of cryptocurrencies.

- Security Risks: Hacks and scams in the crypto space pose a threat to investors’ funds.

- Potential Rewards: High returns on investment, early adoption benefits, and financial independence opportunities.

Building a Diversified Crypto Portfolio

Diversification is key when it comes to building a successful crypto portfolio. By spreading your investments across different types of cryptocurrencies, you can help mitigate risks and maximize potential returns.

Strategies for Diversifying a Crypto Portfolio

- Allocate investments across various cryptocurrency sectors, such as DeFi, NFTs, and stablecoins.

- Invest in a mix of established cryptocurrencies like Bitcoin and Ethereum, along with promising altcoins.

- Consider including different asset classes like tokens, coins, and utility tokens in your portfolio.

Examples of Diversification Benefits in Crypto

- Diversifying can reduce the impact of a single crypto’s price volatility on your overall portfolio.

- During market downturns, having a diverse portfolio can help cushion losses and provide stability.

- If one sector of the crypto market performs poorly, other sectors may still generate positive returns.

Importance of Balancing High-Risk and Low-Risk Assets

- High-risk assets like meme coins and new ICOs can offer high rewards but come with higher volatility and potential for losses.

- Low-risk assets such as stablecoins and blue-chip cryptocurrencies provide stability but may have lower growth potential.

- By balancing high-risk and low-risk assets in your portfolio, you can achieve a mix of growth opportunities and stability.

Long-Term Investment Strategies

Investing in crypto assets requires a unique approach to maximize long-term growth potential. By implementing specific strategies tailored for the volatile nature of the crypto market, investors can build wealth over time.

HODLing in Crypto Wealth Building

HODLing refers to holding onto your crypto assets for an extended period, regardless of market fluctuations.

- By adopting a HODLing strategy, investors aim to capitalize on the long-term appreciation of their crypto holdings.

- It allows investors to avoid making impulsive decisions based on short-term market movements, focusing on the overall growth potential of the assets.

- HODLing is especially crucial in the crypto space, where prices can be highly volatile, requiring patience and a long-term perspective.

Dollar-Cost Averaging for Long-Term Growth

Dollar-cost averaging involves investing a fixed amount of money in crypto assets at regular intervals, regardless of price fluctuations.

- This strategy helps mitigate the impact of market volatility by spreading out the investment over time.

- Investors can benefit from both market lows and highs, as the fixed investment amount buys more units when prices are low and fewer units when prices are high.

- By consistently investing in crypto assets through dollar-cost averaging, investors can potentially lower the average cost per unit over time and benefit from long-term growth.

Managing Risk and Security: How To Leverage Crypto For Long-Term Wealth Building

When it comes to leveraging crypto for long-term wealth building, managing risk and ensuring security are crucial aspects to consider. By implementing best practices, staying informed about market trends, and practicing risk management, you can protect your investments and maximize your potential returns.

Securing and Storing Crypto Assets, How to Leverage Crypto for Long-Term Wealth Building

Securing and storing your crypto assets properly is essential to safeguarding your wealth. Consider the following best practices:

- Use hardware wallets or cold storage solutions to store your crypto offline and protect it from online threats.

- Enable two-factor authentication on your exchange accounts and wallets to add an extra layer of security.

- Regularly update your software and use strong, unique passwords to prevent unauthorized access to your assets.

Staying Informed about Market Trends and Regulatory Changes

Staying informed about market trends and regulatory changes in the crypto space is essential for making informed investment decisions. Here are some tips to help you stay updated:

- Follow reputable crypto news sources to stay informed about market developments and emerging trends.

- Monitor regulatory changes and adapt your investment strategy accordingly to mitigate potential risks.

- Join online communities and forums to engage with other crypto enthusiasts and stay updated on the latest industry news.

Risk Management in Volatile Crypto Markets

Investing in volatile crypto markets comes with inherent risks. To effectively manage these risks, consider the following tips:

- Diversify your portfolio across different cryptocurrencies to spread risk and minimize exposure to price fluctuations.

- Set stop-loss orders to automatically sell your assets if prices drop below a certain threshold, preventing further losses.

- Avoid emotional trading and make decisions based on thorough research and analysis to reduce impulsive decisions.