How to Get Started with Crypto Trading takes center stage, ushering readers into a world of digital currency trading. Get ready to dive into the exciting realm of cryptocurrency with this comprehensive guide.

In this guide, we’ll explore the basics of crypto trading, from understanding what it is to developing a solid trading strategy. Whether you’re a novice or experienced trader, there’s something here for everyone looking to venture into the world of cryptocurrencies.

Setting Up a Crypto Wallet

When it comes to crypto trading, having a secure and reliable crypto wallet is essential. This digital wallet allows you to store, send, and receive various cryptocurrencies.

Types of Crypto Wallets

- Hardware Wallets: These physical devices store your private keys offline, providing extra security.

- Software Wallets: These are digital wallets that can be accessed through desktop or mobile applications.

- Web Wallets: Online wallets that can be accessed through a web browser, convenient but potentially less secure.

- Paper Wallets: A physical document with your public and private keys printed on it, offering offline storage.

Creating and Securing a Crypto Wallet

- Choose a reputable wallet provider based on your preferences and security needs.

- Follow the instructions to create a new wallet, which usually involves setting up a password or PIN.

- Backup your wallet’s recovery phrase and store it in a safe place offline. This phrase is crucial for recovering your wallet if you lose access.

- Enable two-factor authentication (2FA) for an extra layer of security.

Importance of Private Keys

Private keys are essential for accessing and managing your cryptocurrency funds. They should be kept confidential and never shared with anyone.

Remember: “Not your keys, not your coins.” – Unknown

Secure Storage of Private Keys

- Consider using a hardware wallet for the most secure storage of your private keys offline.

- Avoid storing private keys on devices connected to the internet to minimize the risk of theft or hacking.

- Use encryption and strong passwords to protect your private keys if stored digitally.

Choosing a Cryptocurrency Exchange: How To Get Started With Crypto Trading

Cryptocurrency exchanges are platforms where you can buy, sell, and trade various digital currencies. When selecting an exchange, it is crucial to consider factors like fees, security measures, and the range of cryptocurrencies available.

Comparing Cryptocurrency Exchanges

- Exchanges vary in terms of fees, with some charging a flat rate per transaction while others use a percentage-based fee structure.

- Security is paramount when choosing an exchange. Look for platforms with strong security measures like two-factor authentication and cold storage for funds.

- Consider the range of cryptocurrencies offered on the exchange. Some platforms may have a limited selection, while others support a wide variety of digital assets.

Choosing a Reputable Exchange, How to Get Started with Crypto Trading

- Research the reputation of the exchange within the crypto community. Look for user reviews and feedback to gauge the platform’s reliability.

- Check if the exchange is regulated and compliant with industry standards. Regulatory oversight can provide an extra layer of security for your investments.

- Look for exchanges that have a transparent fee structure and provide clear information on their security protocols.

Factors to Consider

- Transaction fees: Compare fees across different exchanges to find the most cost-effective option for your trading needs.

- Security features: Opt for exchanges with robust security measures to protect your funds from cyber threats.

- Cryptocurrency selection: Choose an exchange that offers the digital assets you are interested in trading.

Developing a Trading Strategy

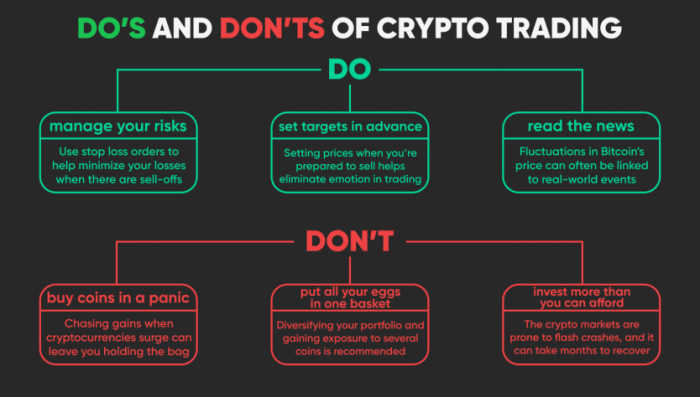

Having a trading strategy is crucial in the world of crypto trading as it helps traders navigate the volatile and unpredictable nature of the market. A well-thought-out strategy can help minimize risks, maximize profits, and ensure disciplined trading practices.

Types of Trading Strategies

- Day Trading: Involves making multiple trades within a single day to capitalize on short-term price fluctuations.

- Swing Trading: Focuses on capturing gains in a cryptocurrency over a period of days to weeks, taking advantage of medium-term trends.

- HODLing: Refers to holding onto a cryptocurrency for the long term, regardless of short-term price fluctuations, based on the belief in its long-term value.

Tips for Developing a Personalized Trading Strategy

- Assess Your Risk Tolerance: Understand how much risk you are willing to take on and adjust your strategy accordingly.

- Set Clear Investment Goals: Define your investment objectives, whether it’s capital growth, income generation, or diversification.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies to reduce risk and increase potential returns.

- Stay Informed: Keep up-to-date with market trends, news, and developments to make informed decisions.

- Test and Adjust: Start with a small amount of capital and test your strategy before committing larger sums. Be prepared to adjust your strategy based on real-world results.

Learning Technical Analysis

Technical analysis is a key aspect of crypto trading that involves analyzing historical price data to predict future price movements. By studying charts and using various tools and indicators, traders can make informed decisions on when to buy or sell cryptocurrencies.

Popular Technical Analysis Tools and Indicators

- Moving Averages: These indicators smooth out price data to identify trends over a specific period of time. Traders use moving averages to determine support and resistance levels.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in the market.

- Bollinger Bands: Bollinger Bands consist of a middle band and two outer bands that react to price volatility. Traders use these bands to identify potential entry and exit points.

- Candlestick Patterns: Candlestick patterns provide visual representations of price movements and can help traders predict market reversals or continuations.

Using Technical Analysis for Informed Trading Decisions

- Example 1: A trader notices that the price of a cryptocurrency has consistently bounced off a certain moving average in the past. This could indicate a strong support level, prompting the trader to buy when the price approaches that level.

- Example 2: By analyzing the RSI of a cryptocurrency, a trader sees that it has been in oversold territory for an extended period. This could signal a potential buying opportunity as the price may soon reverse and move upwards.

- Example 3: When Bollinger Bands tighten around the price of a cryptocurrency, it suggests decreasing volatility. Traders may interpret this as a precursor to a significant price movement and adjust their trading strategy accordingly.

Practicing Risk Management

When it comes to crypto trading, managing risks is crucial to protect your investments and maximize profits. It involves strategies like setting stop-loss orders, diversifying your portfolio, and proper position sizing.

Setting Stop-Loss Orders

Setting stop-loss orders is a key risk management strategy in crypto trading. It allows you to automatically sell a cryptocurrency when it reaches a certain price, helping you limit potential losses.

Diversification and Position Sizing

Diversification involves spreading your investments across different cryptocurrencies to reduce the impact of a single asset’s price fluctuation on your overall portfolio. Position sizing, on the other hand, refers to determining the amount of capital to allocate to each trade based on your risk tolerance and overall portfolio size.