How to Avoid Crypto Investment Scams introduces you to the shady world of digital currency fraud, offering insights that are both eye-opening and essential for savvy investors. Get ready to dive into the details of protecting your hard-earned money from cunning scammers.

Introduction to Crypto Investment Scams

Crypto investment scams are deceptive schemes designed to trick individuals into investing in fake or non-existent cryptocurrencies or blockchain projects, ultimately leading to financial loss. These scams take advantage of the growing popularity and lack of regulation in the digital currency space, making it easier for scammers to target unsuspecting investors.

Prevalence of Crypto Investment Scams

Crypto scams have become increasingly prevalent in recent years due to the anonymity and decentralization of cryptocurrencies, making it difficult to track and recover funds once they are stolen. According to the Federal Trade Commission (FTC), reports of cryptocurrency investment scams have surged by over 1000% since 2020, with losses totaling millions of dollars.

- Scammers often use fake websites, social media, and online forums to promote fraudulent investment opportunities, promising high returns with little to no risk.

- Phishing attacks, Ponzi schemes, and fake ICOs (Initial Coin Offerings) are common tactics used by scammers to lure in victims and steal their money.

- One report found that nearly 30% of all cryptocurrency users have been exposed to some form of scam, highlighting the pervasive nature of these fraudulent schemes.

Common Types of Crypto Investment Scams: How To Avoid Crypto Investment Scams

Crypto investment scams come in various forms, preying on unsuspecting individuals looking to make a quick profit in the cryptocurrency market. Understanding the common types of scams can help investors protect themselves from falling victim to fraudulent schemes.

Ponzi Schemes

Ponzi schemes are one of the oldest and most notorious types of investment scams. In a Ponzi scheme, the scammer promises high returns to investors but uses the capital from new investors to pay off earlier investors. This creates the illusion of profitability until the scam inevitably collapses, leaving many investors with significant losses. One well-known example of a crypto Ponzi scheme is Bitconnect, which collapsed in 2018 after amassing billions of dollars from unsuspecting investors.

Fake ICOs

Initial Coin Offerings (ICOs) are a popular way for cryptocurrency projects to raise funds. However, scammers have taken advantage of this by creating fake ICOs to lure investors into investing in non-existent or worthless tokens. These scams often use fake websites, misleading information, and false promises to convince investors to part with their money. One infamous example is the Centra Tech ICO, which raised over $25 million through false claims before being shut down by the SEC.

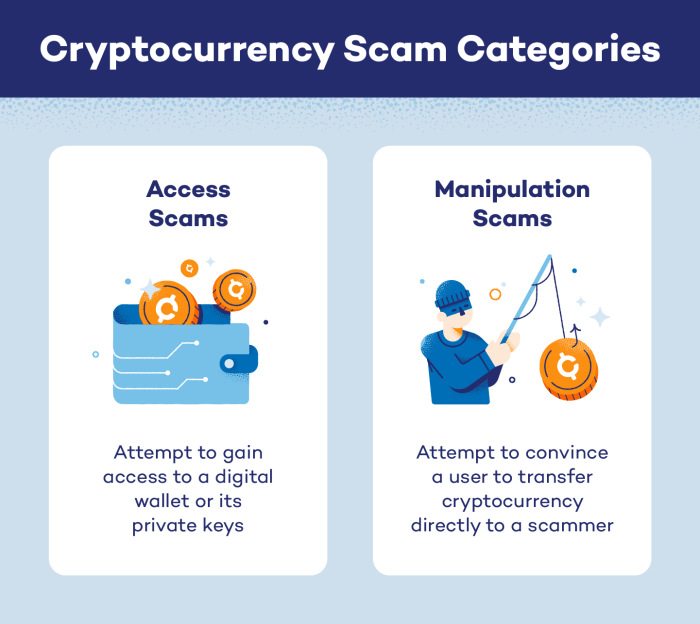

Phishing

Phishing scams involve tricking individuals into revealing their sensitive information, such as passwords or private keys, by posing as a legitimate entity. In the context of crypto investments, scammers may send fake emails or create fake websites posing as popular exchanges or wallet providers to steal users’ credentials. Once scammers have access to this information, they can easily drain victims’ accounts of their funds.

Pump-and-Dump Schemes

Pump-and-dump schemes involve artificially inflating the price of a low-value cryptocurrency through false or misleading statements to attract investors. Once the price is pumped up, the scammers sell off their holdings at a profit, causing the price to crash and leaving other investors with significant losses. These schemes often target inexperienced investors looking to make quick profits in the volatile crypto market.

Red Flags to Watch Out For

When considering a crypto investment opportunity, it’s crucial to be aware of red flags that may indicate a potential scam. Here are some warning signs to watch out for:

Unrealistic Returns

- Be cautious of investment opportunities promising incredibly high returns with little to no risk. If it sounds too good to be true, it probably is.

- Research typical returns for legitimate investments in the crypto market to have a benchmark for comparison.

Lack of Transparency

- Scammers often avoid providing clear information about their company, team, or how the investment works.

- Look for whitepapers, roadmaps, and information about the team behind the project to ensure transparency.

Pressure to Invest Quickly

- Scammers may create a sense of urgency by pressuring you to invest quickly before you have time to do proper research.

- Take your time to thoroughly investigate the opportunity and don’t let anyone rush you into a decision.

Unsolicited Offers

- Be wary of unsolicited offers or messages promoting a particular investment opportunity.

- Always do your own research and never invest based on unsolicited advice or recommendations.

Lack of Regulation

- Check if the investment opportunity is regulated by relevant authorities to ensure it complies with legal requirements.

- Investing in regulated platforms provides an additional layer of security and protection for your funds.

How to Avoid Falling Victim to Crypto Investment Scams

When it comes to navigating the world of crypto investments, protecting yourself from scams is crucial. Here are some strategies to help you avoid falling victim to crypto investment scams:

Conduct Thorough Research Before Investing

Before investing in any crypto project, it is essential to conduct thorough research. This includes investigating the team behind the project, the technology they are developing, and the problem they are aiming to solve. Look for whitepapers, roadmaps, and any other relevant information that can give you insight into the legitimacy of the project.

- Check the team’s background and experience in the crypto industry.

- Verify the project’s partnerships and collaborations with reputable organizations.

- Read reviews and feedback from other investors to gauge the project’s credibility.

- Look for red flags such as unrealistic promises or lack of transparency.

Remember, knowledge is power when it comes to making informed investment decisions in the crypto space.

Verify the Credibility of a Crypto Platform or Project

Verifying the credibility of a crypto platform or project is another crucial step in avoiding scams. Here are some tips to help you determine if a project is legitimate:

- Check if the project has a strong community presence and active social media channels.

- Look for audits conducted by reputable firms to ensure the project’s security and transparency.

- Verify the project’s compliance with regulatory requirements in the jurisdictions they operate in.

- Avoid projects that promise guaranteed returns or use high-pressure sales tactics.

By following these strategies and conducting thorough research, you can protect yourself from falling for crypto investment scams and make more informed investment decisions in the volatile world of cryptocurrency.

Reporting Crypto Investment Scams

Reporting crypto investment scams is crucial in protecting yourself and others from falling victim to fraudulent schemes. By reporting these scams, you help authorities investigate and take action against scammers, preventing further harm to unsuspecting individuals.

Importance of Reporting to Relevant Authorities, How to Avoid Crypto Investment Scams

- Reporting scams to the relevant authorities can help stop scammers in their tracks and prevent them from defrauding more people.

- Authorities need accurate information from victims to build cases against scammers and bring them to justice.

- Reporting can also help regulatory bodies identify trends and patterns in scam activities, leading to better prevention strategies in the future.

Where and How to Report Suspected Crypto Scams

- If you believe you have encountered a crypto investment scam, you can report it to organizations like the Federal Trade Commission (FTC), the Securities and Exchange Commission (SEC), or the Commodity Futures Trading Commission (CFTC).

- You can also report scams to platforms where they are advertised, such as social media sites or online marketplaces, to help prevent others from falling victim.

- Provide detailed information about the scam, including any communication you’ve had with the scammers, to aid in the investigation.

Role of Regulatory Bodies in Combating Crypto Investment Fraud

- Regulatory bodies play a crucial role in monitoring and regulating the crypto industry to protect investors from fraudulent activities.

- These agencies work to enforce laws and regulations that govern crypto investments, ensuring transparency and accountability in the market.

- By collaborating with law enforcement agencies, regulatory bodies can investigate and prosecute individuals or organizations engaged in crypto investment scams.