How Crypto Can Become a Global Payment Method sets the stage for a revolutionary journey into the world of cryptocurrencies, where innovation and challenges intertwine to shape the future of payments.

Get ready to dive deep into the factors, technologies, and security considerations that impact the adoption and use of crypto on a global scale.

Factors Influencing Crypto Adoption as a Global Payment Method: How Crypto Can Become A Global Payment Method

Cryptocurrencies have the potential to revolutionize the way we conduct transactions on a global scale. Several key factors play a significant role in influencing the adoption of cryptocurrencies as a mainstream payment method.

Advantages of Using Crypto for Global Transactions

- Decentralization: Cryptocurrencies operate on a decentralized network, eliminating the need for intermediaries like banks, which can speed up transactions and reduce costs.

- Security: Cryptocurrencies use advanced encryption techniques to secure transactions, making them less susceptible to fraud and hacking.

- Accessibility: Cryptocurrencies can be accessed by anyone with an internet connection, providing financial services to the unbanked population.

- Low Transaction Fees: Compared to traditional payment methods, crypto transactions often have lower fees, especially for international transfers.

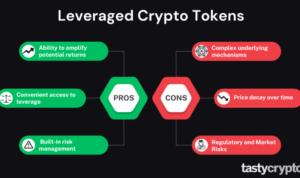

Disadvantages of Using Crypto for Global Transactions

- Volatility: Cryptocurrency prices can fluctuate significantly, posing a risk to both buyers and sellers in terms of value preservation.

- Lack of Regulation: The absence of a comprehensive regulatory framework can lead to uncertainty and potential misuse of cryptocurrencies for illicit activities.

- Technical Complexity: Understanding and managing cryptocurrencies require a certain level of technical knowledge, which may deter some users.

Role of Regulations in Shaping Crypto Payments Worldwide

- Regulatory Clarity: Clear and consistent regulations can provide legitimacy to cryptocurrencies, encouraging businesses and consumers to adopt them for payments.

- Compliance Requirements: Regulations can help establish standards for KYC (Know Your Customer) and AML (Anti-Money Laundering) practices, ensuring the legitimacy of transactions.

- Consumer Protection: Regulations can protect consumers from fraud and ensure accountability in case of disputes or issues with crypto payments.

Technological Challenges and Solutions for Crypto Payment Integration

Cryptocurrencies face several technological challenges that hinder their widespread adoption as a global payment method. Some of these challenges include scalability issues, slow transaction speeds, and lack of user-friendly interfaces. However, innovative solutions and technologies can address these challenges and make crypto payments more accessible globally.

Scalability and Transaction Speed

Scalability is a crucial factor in enhancing the usability of cryptocurrencies as a payment method. Currently, most blockchain networks have limited transaction processing capabilities, leading to congestion and delays in transactions. To address this challenge, developers are exploring solutions such as:

- Layer 2 solutions like the Lightning Network, which enable faster and cheaper off-chain transactions.

- Sharding, a technique that divides the blockchain into smaller parts to increase transaction throughput.

- Consensus algorithm improvements to optimize block validation and increase transaction speeds.

Improving scalability and transaction speeds not only enhances the user experience but also makes cryptocurrencies more competitive with traditional payment systems like credit cards and online banking. As the technology continues to evolve, we can expect to see more efficient and seamless crypto payment solutions in the future.

Security and Privacy Considerations in Crypto Transactions

Cryptocurrency transactions pose security risks due to the decentralized nature of blockchain technology. One common risk is the potential for hacking and theft of digital assets. To mitigate these risks, it is essential to implement robust security measures and best practices.

Role of Blockchain Technology

Blockchain technology plays a crucial role in ensuring the security and privacy of crypto payments. The decentralized and immutable nature of blockchain ledgers makes it difficult for malicious actors to tamper with transaction data. Additionally, the use of cryptographic techniques such as public and private keys enhances the security of crypto transactions.

User Education and Awareness, How Crypto Can Become a Global Payment Method

User education and awareness are key factors in maintaining secure crypto transactions on a global scale. It is important for users to understand the basics of cryptocurrency security, such as the importance of keeping their private keys secure and using reputable wallets and exchanges. Educating users about common scams and phishing attacks can help prevent them from falling victim to fraudulent activities in the crypto space.

Cross-Border Transactions and Currency Conversion with Crypto

Cryptocurrencies offer numerous benefits for cross-border transactions compared to traditional payment methods. The decentralized nature of cryptocurrencies allows for faster transactions, lower fees, and increased security and privacy. Additionally, using cryptocurrencies eliminates the need for third-party intermediaries, reducing the risk of fraud and delays in cross-border payments.

Benefits of Using Cryptocurrencies for Cross-Border Transactions

- Cryptocurrencies enable faster transactions compared to traditional banking systems, which can take days to process cross-border payments.

- Lower transaction fees when using cryptocurrencies for international payments, saving money for both businesses and individuals.

- Increased security and privacy with blockchain technology, ensuring that sensitive financial information is protected during cross-border transactions.

Challenges of Currency Conversion and Volatility in Global Crypto Payments

- Currency conversion can be a challenge when using cryptocurrencies for cross-border transactions, as exchange rates can fluctuate rapidly.

- The volatility of cryptocurrencies can also impact the value of transactions, leading to potential losses or gains for parties involved in global crypto payments.

Examples of Successful Cross-Border Payment Solutions with Cryptocurrencies

- Ripple’s XRP cryptocurrency has been leveraged by financial institutions for fast and cost-effective cross-border payments, providing real-time settlement and lower fees.

- Stellar Lumens (XLM) blockchain network has been used by companies like IBM for cross-border transactions, offering fast and secure international payments.