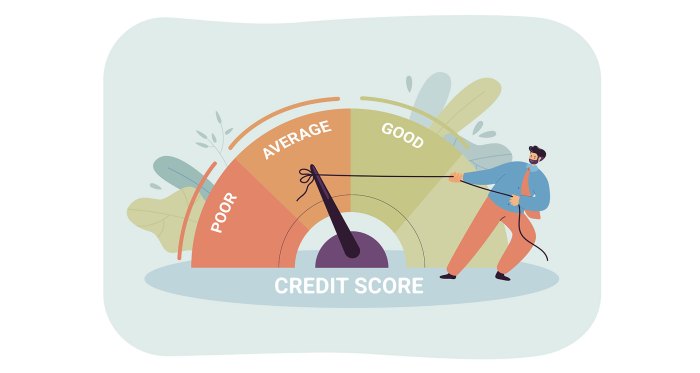

Credit Score Improvement is crucial for your financial well-being. Dive into the world of credit scores and discover effective ways to enhance your score for a brighter future.

Understanding the factors that influence your credit score and implementing strategies to build a positive credit history are key steps towards achieving a better financial standing.

Understanding Credit Scores

A credit score is a numerical representation of an individual’s creditworthiness based on their credit history. It is calculated using a complex algorithm that takes into account various factors.

Importance of a Good Credit Score

Your credit score plays a crucial role in determining your financial health. A good credit score can open doors to better loan terms, lower interest rates, and higher credit limits, while a poor credit score can lead to higher interest rates, limited financial opportunities, and difficulty obtaining credit.

Factors Influencing a Credit Score

- Payment History: This is the most significant factor affecting your credit score. It shows how consistently you pay your bills on time.

- Credit Utilization Ratio: This ratio compares the amount of credit you are using to the total amount available to you. Keeping this ratio low can positively impact your credit score.

- Length of Credit History: The longer your credit history, the more data lenders have to assess your creditworthiness.

- Credit Mix: Having a mix of credit types, such as credit cards, loans, and mortgages, can positively impact your credit score.

- New Credit Inquiries: Opening multiple new credit accounts in a short period can negatively impact your credit score.

Ways to Improve Credit Score

Improving your credit score is essential for better financial opportunities and lower interest rates on loans. Here are some tips to help you boost your credit score:

Make On-Time Payments, Credit Score Improvement

One of the most impactful ways to improve your credit score is by making on-time payments. Payment history makes up a significant portion of your credit score, so consistently paying your bills on time can positively impact your score.

Reduce Credit Utilization

Another important factor in determining your credit score is your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. Lowering your credit utilization by paying down balances can help improve your credit score.

Monitoring Credit Score

Monitoring your credit score regularly is crucial for staying on top of your financial health. By keeping a close eye on your credit score, you can catch any discrepancies or issues early on and take steps to address them before they have a negative impact on your overall creditworthiness.

Importance of Monitoring

- Check your credit report regularly to ensure all information is accurate and up to date.

- Monitor for any sudden drops in your credit score, which could indicate potential fraud or identity theft.

- Identify areas where you can make improvements to boost your credit score over time.

Ways to Monitor

- Sign up for a credit monitoring service that provides regular updates on your credit score and any changes to your credit report.

- Request a free copy of your credit report from each of the three major credit bureaus once a year and review it for any errors.

- Set up alerts on your credit accounts to notify you of any unusual activity or changes to your credit score.

Benefits of Monitoring

- Early detection of errors or inaccuracies on your credit report can help you dispute and correct them promptly.

- Keeping track of your credit score can motivate you to maintain healthy credit habits and work towards improving your score.

- Regular monitoring allows you to identify patterns or behaviors that may be negatively impacting your credit score, so you can take steps to address them proactively.

Building Credit History: Credit Score Improvement

Building a positive credit history is crucial for financial success as it impacts your ability to secure loans, mortgages, and even certain job opportunities. Lenders use your credit history to assess your creditworthiness, so maintaining a good credit history is essential.

Strategies for Establishing and Maintaining Good Credit Habits

- Pay your bills on time: Late payments can have a negative impact on your credit score, so make sure to pay your bills by the due date.

- Keep your credit card balances low: Aim to use no more than 30% of your available credit to show responsible credit management.

- Monitor your credit report regularly: Check your credit report for errors and identity theft, and dispute any inaccuracies.

- Limit new credit applications: Applying for multiple lines of credit in a short period can raise red flags to lenders.

- Establish a mix of credit types: Having a diverse credit portfolio, including credit cards, loans, and a mortgage, can demonstrate responsible credit management.

The Role of Credit History in Credit Score Improvement

Building a positive credit history is a key factor in improving your credit score. By demonstrating responsible credit habits over time, such as paying bills on time and keeping credit card balances low, you can gradually increase your credit score. Lenders look at your credit history to assess your ability to manage credit responsibly, so continuing to build a strong credit history is essential for credit score improvement.