Building a Savings Plan sets the stage for a secure financial future, guiding you through the essential steps to achieve your money goals. From setting realistic savings targets to investing wisely, this comprehensive guide will show you the way to financial freedom.

Importance of Saving Money

Saving money is crucial for achieving financial stability and peace of mind. Having a savings plan in place can provide a safety net during unexpected situations and help you reach your long-term financial goals.

Benefits of Having a Savings Plan

- Emergency Fund: A savings plan allows you to build an emergency fund to cover unexpected expenses like medical bills, car repairs, or home maintenance.

- Financial Security: By saving regularly, you can create a cushion for yourself and your family in case of job loss or other financial setbacks.

- Reach Goals: Saving money enables you to work towards big life goals, such as buying a house, starting a business, or retiring comfortably.

Examples of Unexpected Expenses

- Medical Emergency: Imagine having to pay for an unexpected hospitalization or surgery. Having savings can help cover these high medical costs without going into debt.

- Car Breakdown: Your car breaking down suddenly can be a significant expense. With savings, you can repair your vehicle without disrupting your budget.

- Home Repairs: From a leaking roof to a broken appliance, home repairs can be costly. Having savings set aside can prevent these expenses from causing financial strain.

Setting Savings Goals: Building A Savings Plan

Setting savings goals is a crucial step in building a solid financial foundation for the future. By defining clear objectives, you can stay motivated and focused on achieving your desired financial milestones.Short-term and long-term savings goals play different roles in your overall financial plan. Short-term goals are typically achievable within a year and can include building an emergency fund, saving for a vacation, or making a large purchase.

Long-term goals, on the other hand, are those that take more time to reach, such as saving for retirement, buying a home, or funding a child’s education.

Prioritizing Financial Goals

- Start by establishing an emergency fund: Aim to save at least three to six months’ worth of living expenses in case of unexpected financial setbacks.

- Focus on high-interest debt: Prioritize paying off debts with high interest rates to avoid accumulating more interest over time.

- Save for retirement: Allocate a portion of your income towards retirement savings, taking advantage of employer-sponsored retirement plans or individual retirement accounts (IRAs).

- Set specific goals: Whether it’s a down payment for a house, a new car, or a dream vacation, define your goals clearly to track your progress and stay motivated.

- Automate your savings: Set up automatic transfers from your checking account to your savings account to ensure consistent contributions towards your financial goals.

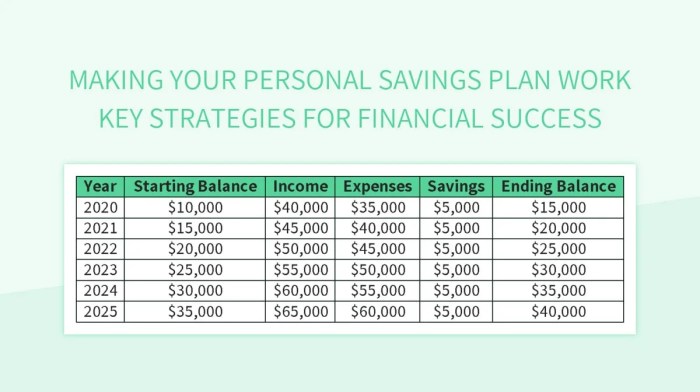

Creating a Budget

Budgeting is a crucial step in building a solid savings plan. It helps individuals track their income and expenses, allowing them to allocate money towards savings goals effectively.

Different Budgeting Methods

- The 50/30/20 Rule: This method suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: With this approach, every dollar is assigned a purpose, ensuring that all income is accounted for and allocated wisely.

- Envelope System: This method involves dividing cash into different envelopes for various spending categories, helping to control expenses.

Tracking Expenses and Adjusting the Budget

- Track Spending: Keep a record of all expenses, whether big or small, to identify areas where you can cut back.

- Review Regularly: Check your budget regularly to see if you are staying on track with your savings goals.

- Adjust as Needed: If you notice that you are overspending in certain areas, adjust your budget by reallocating funds to prioritize savings.

Building an Emergency Fund

Having an emergency fund is a crucial part of any savings plan as it provides a financial safety net for unexpected expenses or situations that may arise.

Significance of Having an Emergency Fund

An emergency fund helps to cover sudden expenses like medical emergencies, car repairs, or unexpected job loss without having to dip into your regular savings or go into debt.

Guidelines on How Much to Save for Emergencies

- Financial experts recommend saving at least three to six months’ worth of living expenses in your emergency fund.

- Calculate your monthly expenses, including rent, utilities, groceries, and other essentials, to determine the amount you need to save.

- Start small if needed and gradually build up your emergency fund over time to reach your target amount.

Where to Keep an Emergency Fund for Easy Access

- Consider keeping your emergency fund in a high-yield savings account or money market account for easy access in case of emergencies.

- Avoid investing your emergency fund in stocks or other volatile assets to ensure that the money is readily available when needed.

- Make sure your emergency fund is separate from your regular savings account to prevent any temptation to use it for non-emergency expenses.

Automating Savings

Automating savings deposits can be a game-changer when it comes to building your nest egg. By setting up automatic transfers from your checking account to your savings, you ensure that a portion of your income goes directly into savings without you having to think about it.

Benefits of Automating Savings

- Ensures consistent savings contributions

- Reduces the temptation to spend the money

- Helps you reach your savings goals faster

- Builds good financial habits over time

Different Ways to Automate Savings

There are several methods to automate your savings:

- Set up direct deposit: Have a portion of your paycheck deposited directly into your savings account.

- Use automatic transfers: Schedule recurring transfers from your checking to your savings account.

- Utilize savings apps: There are apps that can help you automate savings by rounding up your purchases and depositing the spare change into savings.

Tips for Making Automatic Savings a Consistent Habit, Building a Savings Plan

- Start small and gradually increase the amount you automate.

- Set specific savings goals to stay motivated.

- Monitor your progress regularly to track your savings growth.

- Avoid the temptation to dip into your savings unless it’s for a true emergency.

Investing Savings

Investing plays a crucial role in a comprehensive savings plan as it allows your money to grow over time through the power of compound interest. By investing your savings wisely, you can potentially earn higher returns compared to keeping your money in a traditional savings account.

The Difference Between Saving and Investing

When you save money, you are essentially putting it aside in a safe place, such as a savings account, with the goal of preserving the principal amount. On the other hand, investing involves putting your money into various financial instruments like stocks, bonds, mutual funds, or real estate with the aim of generating a return on your investment.

Beginner-Friendly Investment Options

- Stock Market: Investing in individual stocks or exchange-traded funds (ETFs) can provide the opportunity for capital appreciation over the long term.

- Mutual Funds: These are professionally managed investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Robo-Advisors: These automated investment platforms create and manage a diversified portfolio for you based on your risk tolerance and financial goals.

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500, providing broad market exposure at a low cost.

Reviewing and Adjusting the Savings Plan

It is crucial to periodically review and adjust your savings plan to ensure it aligns with your financial goals and current situation.

Frequency of Assessment

Regularly assess your savings plan at least once every three to six months to track progress and make necessary changes.

Indicators for Adjustment

- Unexpected expenses that impact your savings goals.

- Changes in income or financial obligations.

- Meeting or exceeding savings targets sooner than expected.

- Changes in economic conditions affecting investments or savings options.

- Major life events like marriage, having children, or buying a home.